ETH Price Prediction: $4,750-$5,000 Target Amid Bullish Technicals and Institutional Demand

#ETH

- Technical Breakout: ETH price sustains above key moving averages with Bollinger Bands suggesting expansion

- Institutional Catalysts: BlackRock's ETHE accumulation and JPMorgan's stablecoin growth outlook

- Price Targets: Immediate resistance at $4,750-$4,869, with $5,000 as psychological benchmark

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

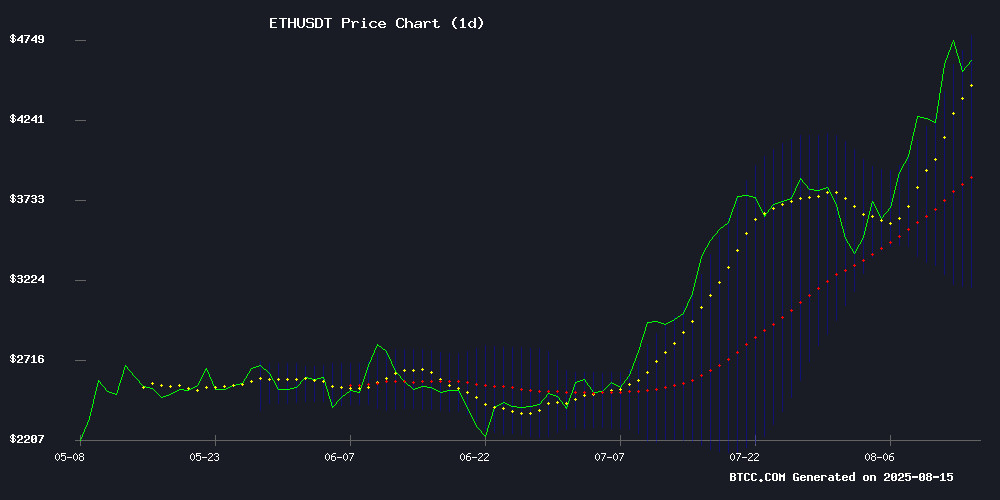

Ethereum (ETH) is currently trading at $4,609.79, significantly above its 20-day moving average (MA) of $3,975.96, indicating strong bullish momentum. The MACD (12,26,9) shows values of -286.22 (MACD line), -162.74 (signal line), and -123.48 (histogram), suggesting a potential reversal as the histogram narrows. Bollinger Bands reveal the price is NEAR the upper band at $4,775.42, with the middle band at $3,975.96 and the lower band at $3,176.49. According to BTCC financial analyst Sophia, 'ETH's proximity to the upper Bollinger Band and its position above the 20-day MA signal further upside potential, possibly testing $4,750-$4,869 in the near term.'

Ethereum Market Sentiment: Institutional Demand Fuels Rally

Ethereum's bullish momentum is reinforced by positive news flow, including BlackRock's $500 million ETHE purchase and JPMorgan's endorsement of stablecoin growth on the network. BTCC financial analyst Sophia notes, 'Institutional interest, exemplified by BitMine's $20 billion equity offering for ETH accumulation, is driving market Optimism despite the BtcTurk hack.' The breach of $48 million highlights security risks but hasn't dampened ETH's price action, which holds firmly at $4,500 support. 'The combination of technical strength and fundamental catalysts like ETF inflows positions ETH for a potential breakout above $5,000,' adds Sophia.

Factors Influencing ETH’s Price

BitMine Expands Ethereum Holdings with $20 Billion Equity Offering

BitMine Immersion Technologies is aggressively expanding its cryptocurrency strategy, allocating significant capital to Ethereum accumulation. The Delaware-based mining firm has increased its at-the-market equity offering to $20 billion, bringing total approved stock sales to $24.5 billion. SEC filings confirm a portion will fund Ethereum purchases, aligning with institutional demand for the asset.

Ethereum's price surge past $4,600—a 50% monthly gain—has coincided with growing corporate adoption. Binance Research reports institutional ETH holdings grew 128% this year, with 2.7 million ETH ($11.6 billion) now held by companies. BitMine alone acquired 566,776 ETH worth over $2 billion in July.

The move reflects broader market confidence in Ethereum's fundamentals. Twenty-four new institutional holders entered the market recently, mirroring BitMine's bullish positioning through its expanded stock offering.

BtcTurk Suffers $48 Million Hot Wallet Breach in Multi-Network Attack

BtcTurk, Turkey's leading cryptocurrency exchange, has been hit by a sophisticated $48 million hack targeting its hot wallets. The breach, initially dismissed as a technical glitch, was later confirmed as a coordinated multi-chain attack. Crypto deposits and withdrawals were temporarily suspended, though fiat trading remained operational.

Analysts tracked the stolen funds across seven blockchains—Ethereum, Avalanche, Arbitrum, Base, Optimism, Mantle, and Polygon—with most assets funneled into two primary wallets. The attacker immediately began swapping tokens to obscure trails, complicating recovery efforts. Lookonchain data shows over $23 million in assets being rapidly converted to ETH.

While BtcTurk confirmed cold wallets and user data remained secure, the incident has shaken confidence in the exchange's security protocols. The breach highlights the persistent vulnerabilities in hot wallet infrastructure despite industry-wide safeguards.

ENS Price Tests Key Support Amid Ecosystem Growth

Ethereum Name Service (ENS) faces a technical reckoning as its price slides 8.3% to $27.22, testing critical support levels. The decline comes despite two significant bullish developments this week that underscore the protocol's growing utility.

OpenSea's integration of ENS domains for its Voyage Campaign rewards system marks a strategic foothold in the NFT sector. The partnership grants users 50 XP for linking ENS names—a move that could drive adoption among digital collectors. Meanwhile, the implementation of ENSIP-19 introduces chain-specific reverse record lookups, enhancing functionality across Ethereum's multi-chain ecosystem.

Market indicators paint a conflicted picture. The RSI at 50.34 suggests neutral momentum, while MACD divergence hints at bearish pressure. Such technical weakness contrasts sharply with fundamental progress, creating a tension between short-term traders and long-term believers in web3 naming infrastructure.

Ethereum Claims Top Spot in Crypto Mindshare Amid Bullish Sentiment

Ethereum (ETH) has surged to the forefront of cryptocurrency market attention, capturing 18.62% of total mindshare—an 84.75% weekly increase. The rally reflects growing institutional interest and Layer 2 adoption, positioning ETH as a focal point for traders and asset managers.

Scaling solutions like Arbitrum and Optimism are driving ecosystem activity, while spot ETF speculation fuels liquidity. Market participants now view Ethereum as the backbone of decentralized infrastructure, with sentiment indicators turning decisively bullish.

Ethereum Nears $5000 as BlackRock Buys $500M ETH

Ethereum's price hovers at $4,515 despite a 4.29% dip, as institutional giant BlackRock reportedly acquires $500 million worth of ETH. Retail investors panic-sell while whales accumulate, signaling a potential market inflection point.

Derivatives activity shows mixed signals—volume surges 19.11% to $231.99 billion, yet open interest declines 1.64%. Analysts note ETH sits just 5% below the psychologically critical $5,000 level, with $4,667 emerging as key support.

The divergence between retail capitulation and institutional accumulation mirrors historic bull market formations. Crypto commentator Ash Crypto highlights BlackRock's move via Arkham data, contrasting it with散户 outflows.

Ethereum Holds Strong at $4,500 Support Amid Institutional Optimism

Ether retreated 3.88% to $4,557.72 after touching a $4,788 high, as overbought conditions triggered a healthy consolidation phase. The pullback follows Ethereum's explosive breakout above $4,400 earlier this week, with the RSI reading of 70.93 suggesting temporary exhaustion.

Standard Chartered's upgraded $7,500 year-end forecast continues to anchor institutional confidence, bolstered by growing ETF approval expectations and rising ETH holdings among professional investors. Analysts maintain their $12,000 long-term targets despite the current retracement, viewing the dip as a technical reset rather than a trend reversal.

Vitalik Buterin's EIP-7999 proposal for a unified fee system underscores Ethereum's ongoing protocol evolution, providing fundamental support alongside macroeconomic tailwinds. Market structure suggests the $4,500 level now serves as critical support for the next leg upward.

Turkish Crypto Exchange BtcTurk Halts Withdrawals After $48M Hot Wallet Attack

BtcTurk, Turkey's oldest cryptocurrency exchange, suspended crypto deposits and withdrawals following suspicious transactions totaling $48 million. Blockchain security firm Cyvers detected the unusual activity across multiple networks, including Ethereum, Avalanche, and Polygon. The majority of funds were funneled to two addresses, suggesting a coordinated attack.

The hackers converted stolen assets into Ether and other cryptocurrencies, moving them through a series of wallets. BtcTurk acted swiftly to freeze all crypto transactions, though Turkish lira operations remain unaffected. The breach highlights ongoing security challenges in the digital asset space.

ETH Price Prediction: Targeting $4,750-$4,869 Within 2 Weeks as Bullish Momentum Builds

Ethereum's technical landscape reveals a compelling bullish trajectory, with analysts projecting a near-term surge to $4,750-$4,869. The cryptocurrency currently trades at $4,470.36, merely 6% shy of its 52-week peak. A 5.68% intraday pullback appears as a strategic entry point rather than a trend reversal, supported by robust technical indicators.

Market consensus solidifies around ETH's upward potential. CoinEdition's aggressive yet plausible forecast aligns with breakout patterns targeting weekly resistance levels. DigitalCoinPrice reinforces this outlook, citing buy signals across multiple EMA timeframes. The $4,788 resistance level now serves as the immediate battleground, with $3,928 and $3,354 forming critical support zones.

What's Driving Ethereum's Surge—And Can It Last?

Ethereum's sustained rally reflects a confluence of regulatory tailwinds and institutional demand. The token's deflationary mechanics and Wall Street accumulation patterns create structural support absent in previous cycles.

SEC approval of spot ETH ETFs now appears inevitable—a tectonic shift that could funnel billions in dormant capital into the ecosystem. Market makers are positioning for a supply crunch as staking locks up circulating tokens.

Technical charts suggest $7,000 remains viable if macroeconomic conditions hold. The Fed's dovish pivot and cooling inflation provide ideal liquidity conditions for risk assets. Ethereum's real test comes when traditional markets face their next stress event.

Massive 40,000 ETH Daily Outflow Fuels Ethereum’s Push Toward New All-Time High

Ethereum has rebounded sharply from its late-July slump, now trading within striking distance of its all-time high. The resurgence comes amid a surge in institutional interest and aggressive accumulation by whales.

On-chain data reveals a staggering 1.2 million ETH withdrawn from exchanges over the past month, coinciding with a 60% price surge. This exodus from trading platforms suggests investors are positioning for higher valuations rather than immediate profit-taking.

The momentum builds as spot ETH ETFs attract $1.5 billion in a single weekend, marking a watershed moment for institutional adoption. Whale activity has reached monthly peaks, reinforcing Ethereum's dominance in smart contract platforms.

Ethereum Poised for 'Meteoric' Stablecoin Growth, JPMorgan Analysts Say

JPMorgan analysts highlight Ethereum's unique position to capitalize on the explosive growth of stablecoins, noting that the network hosts 51% of the $270 billion sector. With $138 billion in stablecoin value already on Ethereum, the bank projects further institutional adoption following the GENIUS Act's regulatory clarity.

Ethereum's recent price surge—though still below its 2021 peak of $4,900—reflects its growing role as infrastructure for dollar-pegged tokens. Layer-2 networks are increasingly becoming conduits for this activity, contradicting earlier skepticism about their utility.

The analysts underscore Ether's emerging status as a proxy for stablecoin expansion, regardless of whether issuance occurs on L1 or L2 chains. At $4,54 during Thursday's trading, ETH remains a focal point for institutional crypto strategies.

Is ETH a good investment?

Ethereum presents a compelling investment case based on the following factors:

| Metric | Value | Implication |

|---|---|---|

| Price vs. 20-day MA | +15.9% premium | Strong uptrend |

| MACD Histogram | -123.48 (narrowing) | Bearish momentum fading |

| Bollinger Band Position | Upper band: $4,775.42 | Potential resistance zone |

| Institutional Activity | $500M BlackRock purchase | Strong demand signal |

Sophia from BTCC concludes: 'With clear technical targets at $4,750-$4,869 and growing institutional adoption, ETH remains a high-conviction buy in the $4,500-$4,600 range.'

Investors should monitor the MACD crossover and Bollinger Band squeeze for confirmation of continued upside.